Payroll city calculator

Subtract any deductions and payroll taxes from the gross pay to get net pay. New employers pay 05.

Hourly To Salary What Is My Annual Income

During World War II payroll withholding and quarterly tax payments were introduced for the first time which still exists in our modern income tax withholding system.

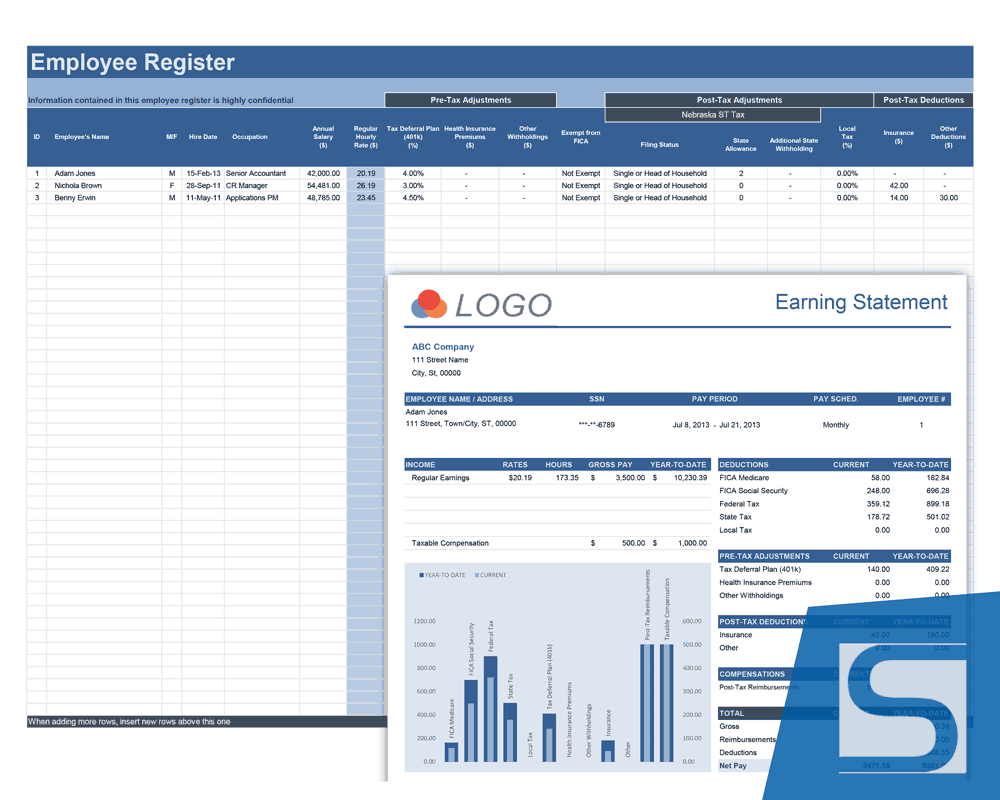

. Switch to Alabama salary calculator. We are The Payroll Department for over 850 businesses and organizations in La Plata County and beyond. The first worksheet is the employee register intended for storing detailed information about each of your employees.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. West Virginia State Unemployment Compensation. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes.

Why Gusto Payroll and more Payroll. Dont want to calculate this by hand. The Citys payroll system is based on the fiscal year covering the period July 1 through June 30.

Free New Jersey Payroll Tax Calculator and New Jersey Tax Rates. The payroll calculator worksheet helps you with calculating the employee payroll based upon regular hours sick leave hours and vacation. Workers receiving their paychecks via direct deposit according to the American Payroll Associations 2020.

New Jersey Payroll Tax Rates. In 2020 an executive memo was released allowing employers to defer payroll taxes for employees. Use our easy payroll tax calculator to quickly run payroll in West Virginia or look up 2022 state tax rates.

Learn about the benefits of this safe and fast way of getting your pay directly on your bank account. Find the banks that offer free checking. An updated look at the Kansas City Royals 2022 payroll table including base pay bonuses options tax allocations.

Additionally IRS Notice 2020-65 allows employers to defer. This payroll template contains several worksheets each of which are intended for performing the specific function. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Exempt means the employee does not receive overtime pay. This Alabama hourly paycheck calculator is perfect for those who are paid on an hourly basis. Switch to Michigan salary calculator.

This payment method has become very common in recent years with nearly 94 of US. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Leicester City 2022 payroll table including breakdowns of salaries bonuses incentives weekly wages and more.

Earnings and Compensation HoursUnits Hourly Rate. Heres a quick rundown of the components that go into federal tax withholdings. Along with payroll-related taxes and withholding New York employers are also responsible for providing employees with State Disability Insurance SDI to cover off-the-job injury or illness.

Calculate how tax changes will affect your pocket. Sep 1 2022 Wout Faes Signed a 5 year contract by transfer from Stade Reims to Leicester City LC for an 187M fee. It can also be used to help fill steps 3 and 4 of a W-4 form.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. The state allows employers to withhold 05 of wages but no more than 060 per week from employees to help fund this policy. Louisiana does not have any local city taxes so all of your employees will pay only the state income tax.

However Newark residents and any non-residents who work in Newark have to pay an additional city tax of 1. Actual rent paid less 10 of the basic salary and 50 of the basic salary if staying in a metro city and 40 in a non-metro city. First of all lets calculate federal payroll taxes for the sake of Uncle Sam.

Run payroll for hourly salaried and tipped employees. Federal individual income tax is the tax collected from individuals by the Internal Revenue Service IRS on taxable income. This number is the gross pay per pay period.

Since 1993 our mission has been to provide you with personal professional confidential and accurate payroll and timekeeping services a mission we continue to stay on one client at. This calculator is intended for use by US. Switch to Oregon salary calculator.

Free Louisiana Payroll Tax Calculator and LA Tax Rates. Then enter the employees gross salary amount. Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022.

Payroll Table 2022 Contracts Active Multi-Year Summary Positional Spending Prospects The Future Free Agents 2023 Player Option. In the event of a conflict between the information from the Pay Rate Calculator and the Payroll Management System calculations from the Payroll Management System prevail. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The PaycheckCity salary calculator will do the calculating for you. Louisiana State Unemployment Insurance SUI. See Missouri tax rates.

As an employer its up to you to withhold the amount calculated by your employee. Learn what to do if your paycheck is lost stolen or damaged. Fiscal Year 2023 beginning July 1 2022 is not a leap year.

Enroll in Direct Deposit. Sage Income Tax Calculator. Subscribe To Newsletter.

Louisiana Payroll Tax Rates. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Its so easy to use. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Automatic deductions and filings direct deposits W-2s and 1099s.

This Oregon hourly paycheck calculator is perfect for those who are paid on an hourly basis. Calculate and print employee paychecks in all 50 states as well as Puerto Rico Guam Virgin Islands and American Samoa. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

So be sure to check with your city to determine the fee amount you have to withhold from your employees paychecks. Kansas City Royals 2022 Payroll. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Check out the Frequently Asked Questions about pay. You can calculate all your employees federal withholdings as well as any additional taxes your business is responsible for paying.

But they can also be levied at the city or county level.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

International Salary Calculator Calculate The Salary You Will Need

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Gross Pay And Net Pay What S The Difference Paycheckcity

Equivalent Salary Calculator By City Neil Kakkar

Compare Salaries In Cities Teleport Eightball

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Payroll Calculator Free Employee Payroll Template For Excel

Indeed Salary Calculator Indeed Com

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Hourly To Salary Pay Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp